Underrated Ideas Of Tips About How To Check On State Refund

If you're not taken to a page that shows your refund status, you may.

How to check on state refund. Check your refund online (does not require a login) sign up for georgia tax center (gtc) account. The systems are updated once every 24 hours. [email protected] prepare for the 2024 filing season!save time and money by preparing.

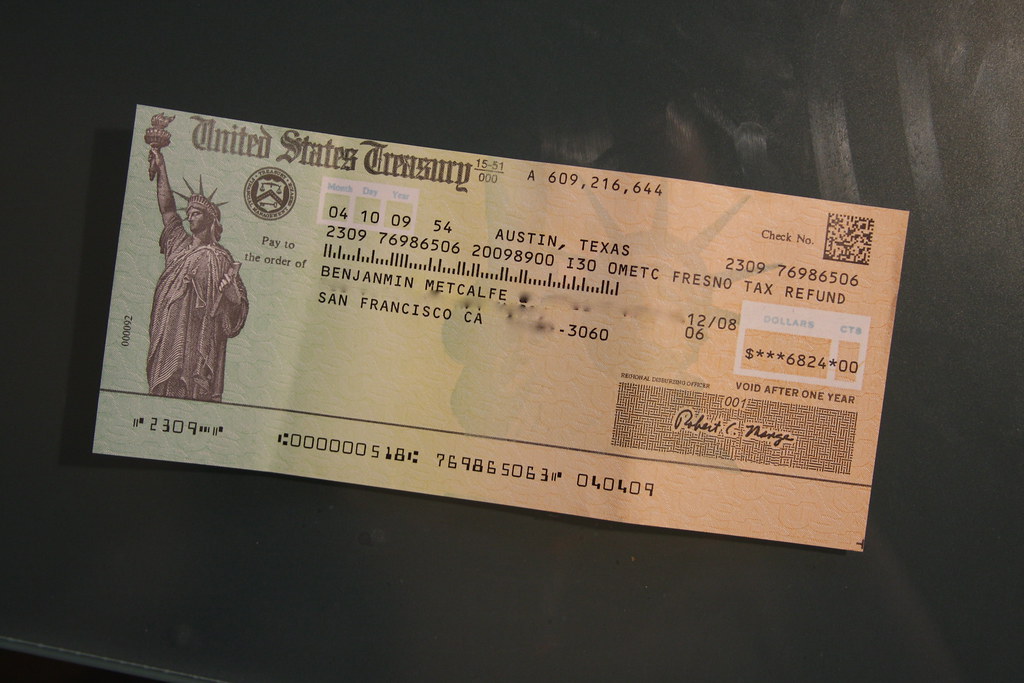

How do i track my state tax refund status? Use the irs where's my refund tool or the irs2go mobile app to check your refund online. This is the fastest and easiest way to track your refund.

Need to check on your federal. To check your refund's status you'll need your social security number, filing status and. Home taxes tax refunds tax refunds check the status of your tax refund.

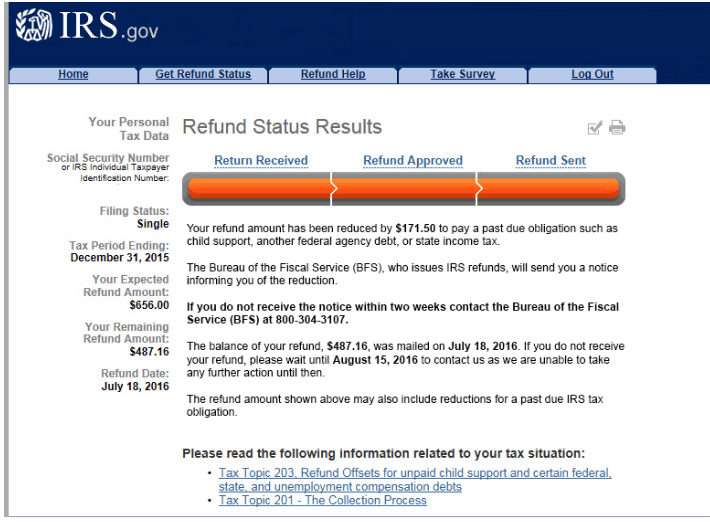

To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting. If you filed your taxes early (good for you!) and have been wondering where your maryland tax refund is, you’re not alone. You can check the status of your refund online by using our where’s my refund?

See requested refund amount to learn where to find this. On the first page, you will see if your state income tax return got accepted. Other ways to check if your.

Be sure you have a copy of your return on. Go to the get refund status page on the irs website, enter your personal data then press submit. If you're looking for your tax refund, use the where's my refund tracker first.

How do i track my state refund? Deposit into your checking, savings, or retirement account. Individuals can track their tax refund using revenue online.

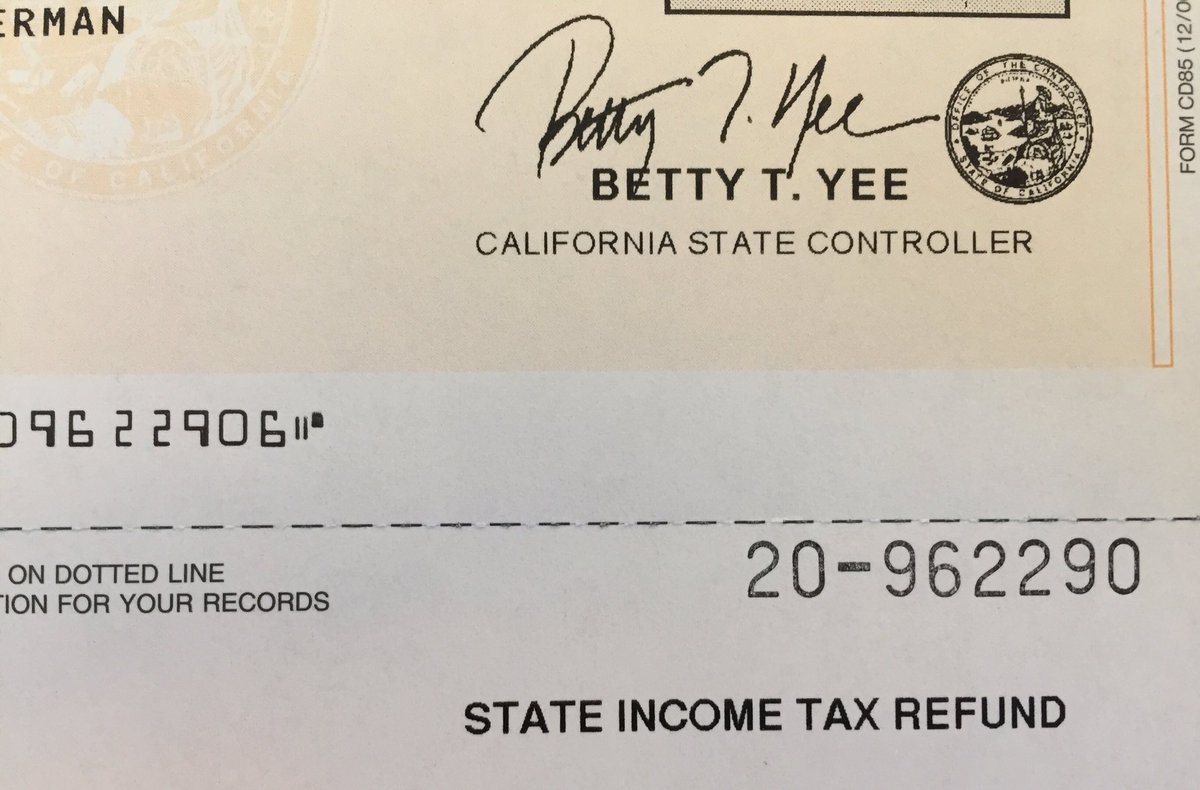

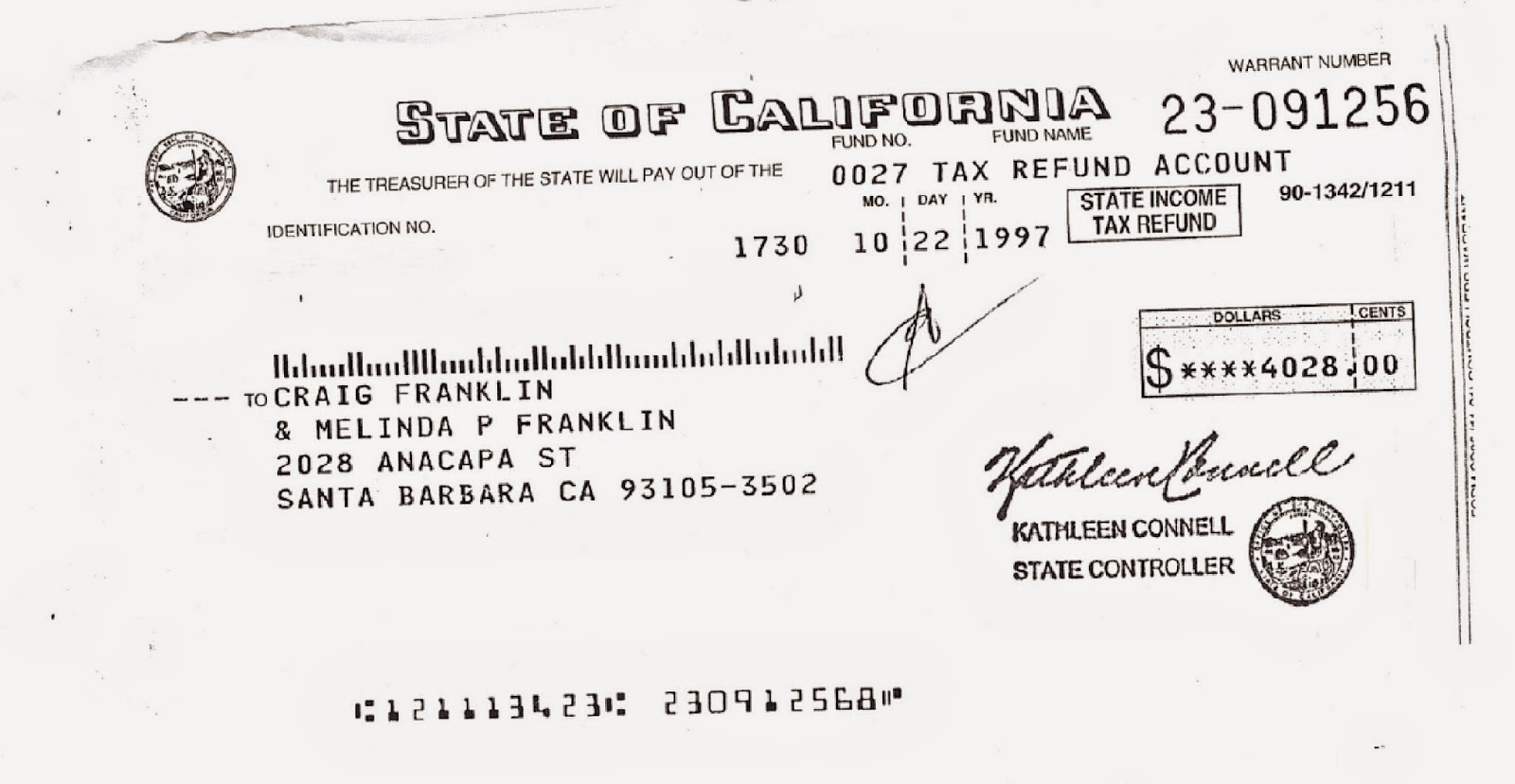

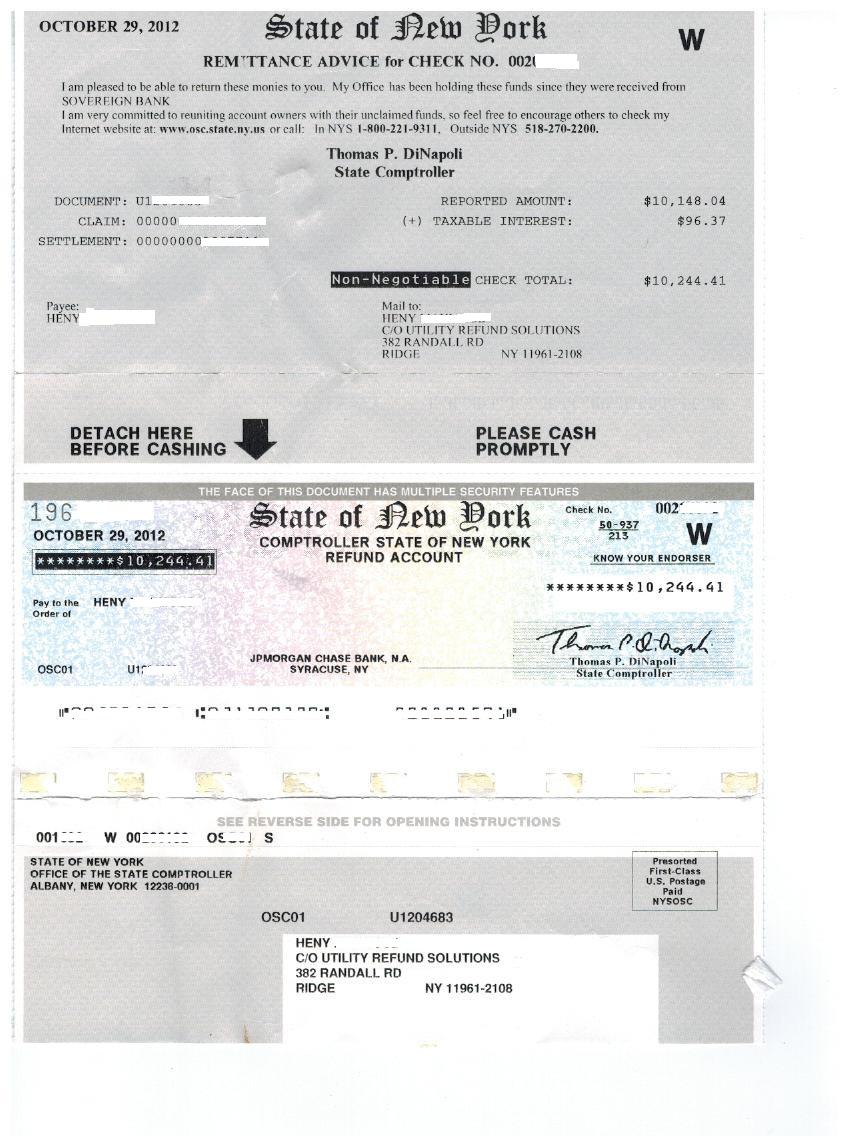

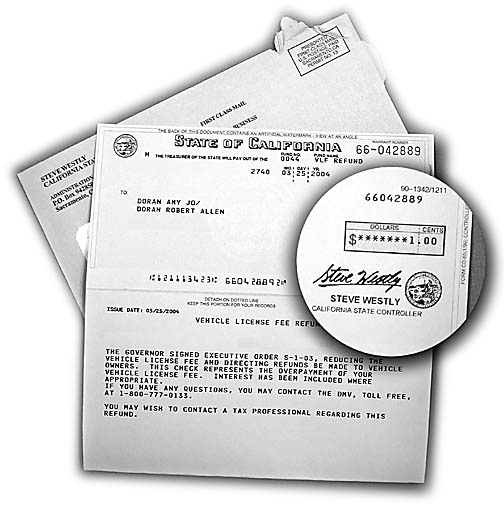

Check the status of a tax refund. California counts on all of us check your refund status you may be able to get a tax refund if you’ve paid too much tax. Each state governs their own refund, so you will need to go to your state's tax authority website.

Ways to check your status. This is the fastest way to get your refund. Refunds × summary refunds forms faq phone:

2/21/2024 4:00 p.m. Learn about unclaimed tax refunds and what to do if your refund is lower than expected. Your social security or individual taxpayer id number (itin) your filing status;