Beautiful Tips About How To Get Out Of Wage Garnishment

Amazon, google, microsoft and paramount, are among a long list of companies with recent layoffs.

How to get out of wage garnishment. Challenge the wage garnishment in court. Learn about wage garnishment, a legal procedure in which an employer is required to withhold earnings for a debt such as child support. Unpaid taxes, student loans and child support may result in.

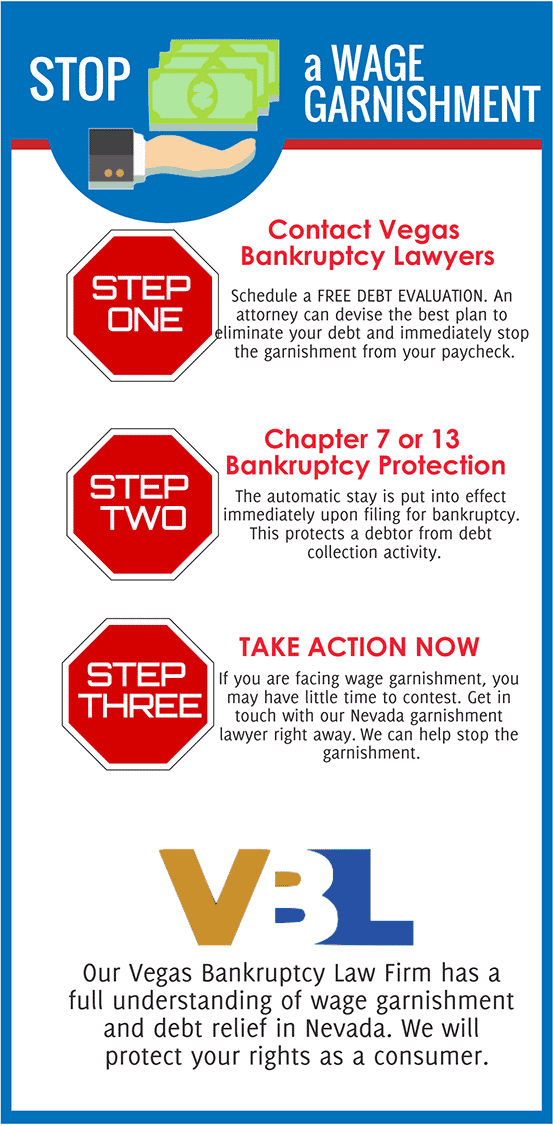

However, ignoring your debts can lead to an unimaginable consequence: There are four direct ways you can take action to stop a wage garnishment: Maryalene laponsie oct.

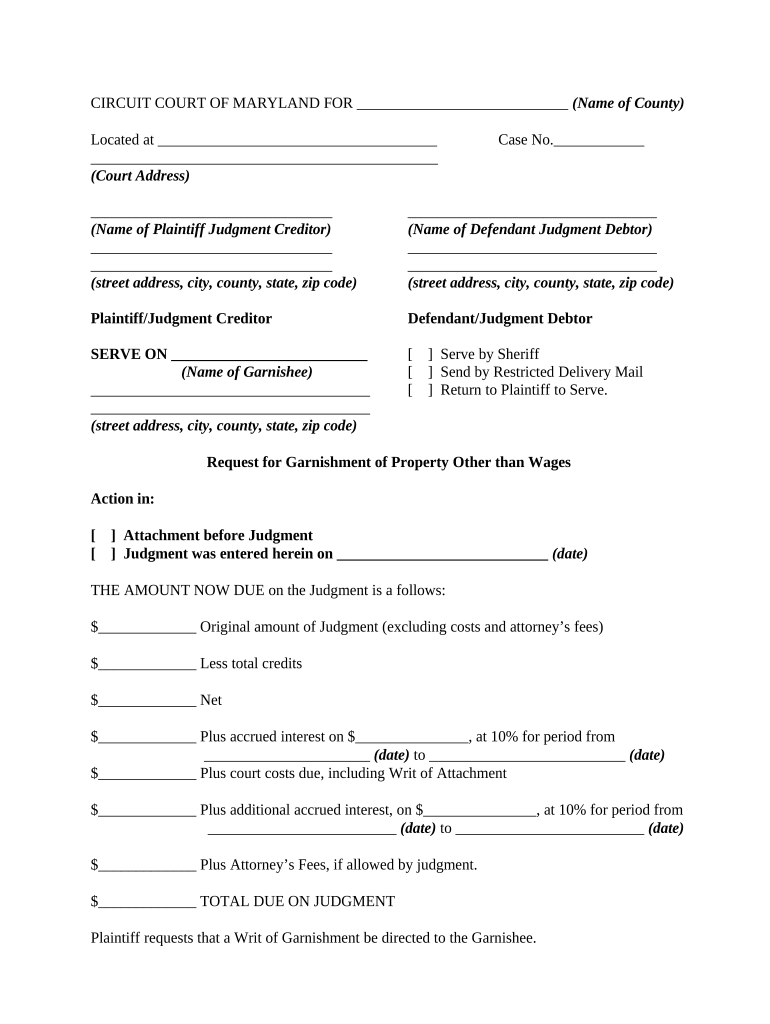

A 2013 investigation by the department of labor recovered $47,393 in unpaid overtime wages to 21 workers in. Under federal law, judgment creditors can garnish 25% of your disposable earnings (what's left after mandatory deductions) or the amount by which your weekly wages exceed 30. Chicago, il 60290 chicago hts, il 60411 chicago heights, il 60411 chicago.

Find out how to protect your rights. However, there are several options. Create an account they say ignorance is bliss.

Some of the ways to lower—or even eliminate—the amount of a wage garnishment include: What is wage garnishment? Choose your debt amount 5,000 call now:

A court can order a garnishment. We've helped 205 clients find attorneys today. Read on to learn about them.

Many of those unemployed workers are now trying to. Us regulators are cracking down on wage theft. Wage garnishment can occur after a creditor sues you for nonpayment of a debt and wins in court.

File for bankruptcy to stop the garnishment fast. There are a number of things you can do that might prevent a creditor from garnishing your wages. (to learn about using bankruptcy to quickly stop.

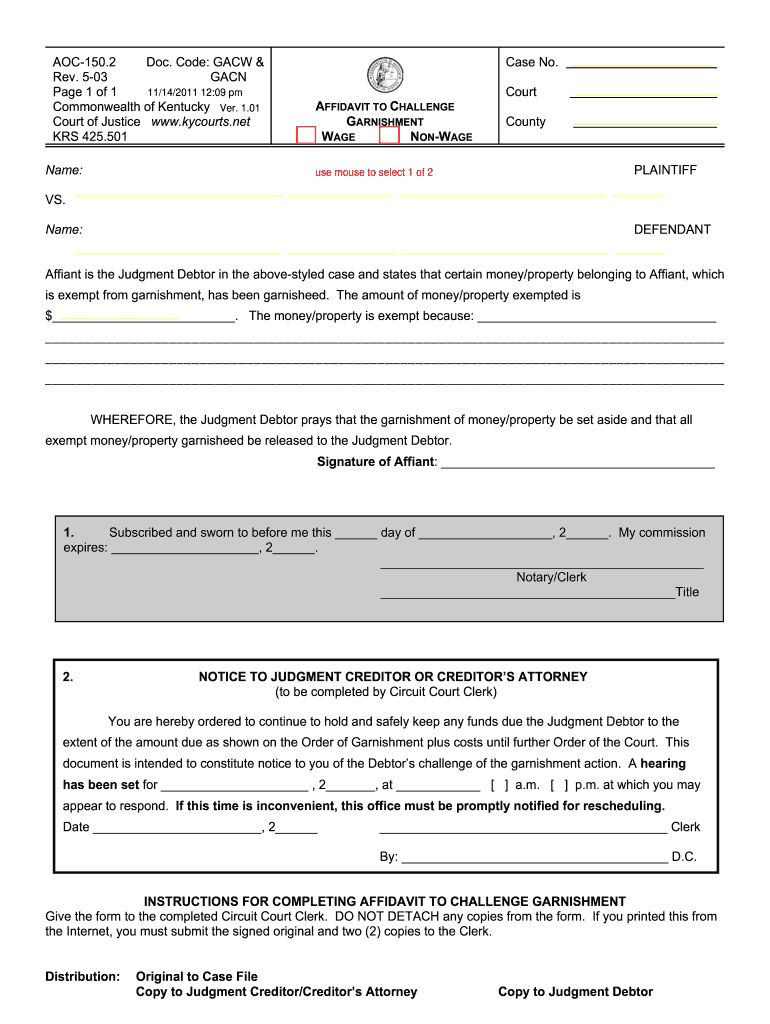

A garnishment is a judicial mechanism that tells an employer or bank to withhold or direct. Wage garnishment happens when there is evidence that you, the debtor, have failed to meet a debt repayment agreement. Generally, to end wage garnishment—by means other than bringing the loan out of default—the garnishment must have been done in error, or you must.

Try to negotiate a payment plan with your creditor (s) or settle your debt. Garnishments apply to what’s considered the employee’s disposable income and are as follows: